Should I Sell When the Market Drops?

No. Almost certainly not.

Unless your circumstances have genuinely changed or your investment plan needs adjusting, selling when markets drop is usually the worst thing you can do.

The case for staying the course when markets wobble

The past 12 months have served up a buffet of uncertainty. Interest rates bouncing around. Inflation refusing to behave. Geopolitical tensions flaring up. Trump's return to the White House. And through it all, markets doing what they do best - swinging up and down like they've had too much coffee.

If you've been watching your portfolio balance wobble and feeling that familiar knot in your stomach, you're not alone. It's completely normal. Your money represents years of hard work, sacrifice, and plans for the future. Of course you want to protect it.

But here's the thing: the real risk isn't the market volatility. It's how you react to it.

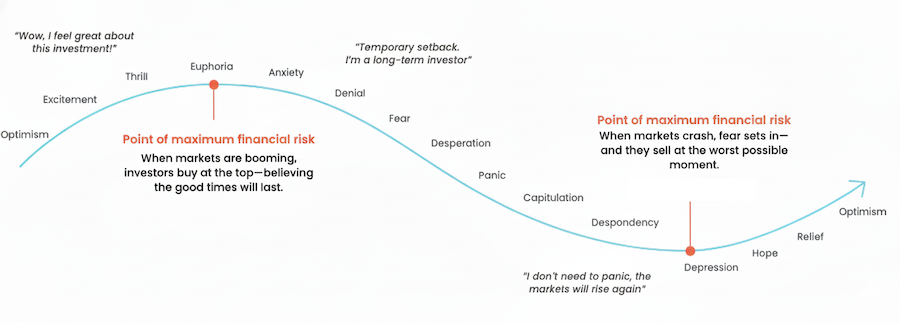

Riding the emotional rollercoaster of investing

When markets are booming, investors feel excited and optimistic - and often buy at the top. When markets fall, fear takes over and many sell at the worst possible moment. This emotional rollercoaster can quietly erode wealth if you let your emotions derail you from your plan.

The emotional rollercoaster of investing

The people who lost a significant chunk of their retirement savings during the Global Financial Crisis didn't lose it because the market crashed. They lost it because they sold when everything was down - crystallising their losses - and then didn't have enough left to recover when markets bounced back. Some didn't have enough cash set aside to cover their living expenses, so they were forced to sell investments at the worst possible time just to pay the bills.

Those horror stories you've heard are real. But they're not about market crashes. They're about panic and poor planning.

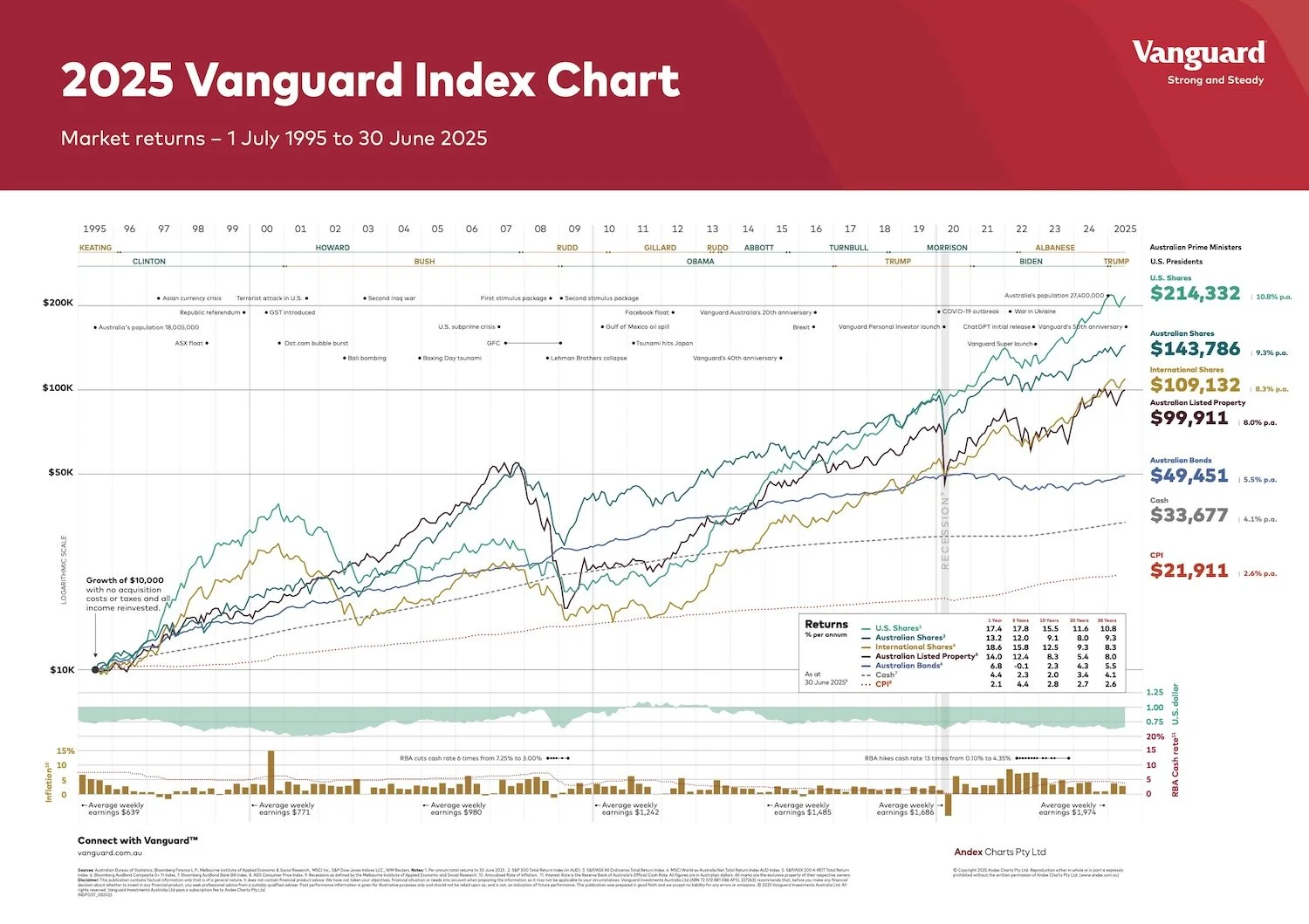

What 30 years of market data actually shows

Take a look at this Vanguard Index Chart. It tracks 30 years of Australian market performance from 1995 to 2025.

Source Vanguard Download Chart.

See all those dips? The Asian currency crisis. The dot-com bubble burst. The GFC. The COVID crash. The 2022 downturn. Every single one felt apocalyptic at the time. The headlines screamed doom. People panicked.

But zoom out. Look at the line over time. Despite every crisis, every recession, every "this time it's different" moment - the trend has been unmistakably upward.

If you'd invested $10,000 in Australian shares in 1995 and stayed invested through all that chaos, you'd have $143,786 by June 2025. That's a 9.3% annual return, through some of the worst financial crises in modern history.

The people who made money weren't the ones frantically buying and selling based on headlines. They were the ones who stayed put.

The danger of trying to time the market

Missing just a handful of the market's best days can seriously damage your long-term returns. And here's the kicker: those best days often happen right after the worst days.

If you sell during a downturn thinking you'll "get back in when things settle down," you'll almost certainly miss the recovery. Because by the time things feel safe again, the market has already bounced back.

Research shows that investors who try to time the market typically underperform those who simply stay invested. It's not because they're not smart enough. It's because market timing is essentially impossible, even for professionals.

What "staying the course" actually means

Staying the course doesn't mean blindly holding onto investments no matter what, never reviewing your portfolio, or ignoring changes in your life.

At Firefly Financial, staying the course means having a proper plan in the first place - one that factors in your feelings about risk, your timeframes, and crucially, having enough set aside in cash and defensive assets to ride out market swings without being forced to sell when everything's down.

It means:

Regular portfolio reviews to make sure your investments still match your goals

Rebalancing when needed - buying low, selling high, the opposite of panic

Strategic shifts when your circumstances change, like retirement, health issues, or helping family

Making decisions based on your plan and your adviser's guidance, not fear

What it definitely doesn't mean is checking your portfolio balance every day and reacting to whatever headline is screaming at you.

Why Firefly clients sleep better during volatility

Our clients aren't immune to market wobbles. But they're structured to weather them.

When we build your investment portfolio and retirement plan, we factor in:

Your risk tolerance - how much volatility you can stomach without losing sleep

Your timeframes - when you'll actually need this money

Cash buffers - enough set aside so you're not forced to sell investments when markets are down

Diversification - spreading risk across different asset types so you're not betting everything on one horse

This means when markets drop, you're not scrambling. You've got enough in cash and defensive assets to cover your living expenses while you wait for markets to recover. Because they always do - eventually.

The bottom line

If you're worried about your portfolio, the best thing you can do is talk to us. We'll look at your situation, review your plan, and make any sensible adjustments if needed.

But what we won't do is help you make panicked decisions based on headlines that are designed to scare you into clicking.

The boring truth about making money in volatile markets? It's about discipline, not drama. It's about having a solid plan and sticking to it, even when - especially when - everyone else is losing their heads.

Join Frankly Speaking

Sign up to receive our monthly newsletter - where the team at Firefly Financial tells it like it is about all things money, life and everything in between.